In the new year, many of us set goals for ourselves. And whether they are career, fitness, personal or financial related, all of us would probably admit it’s a good idea to scrub our monthly budgets on a regular, or at least yearly, basis. For those of you reading this wondering how to even get started with a household budget, here are five easy steps to help you create a budget you can stick to:

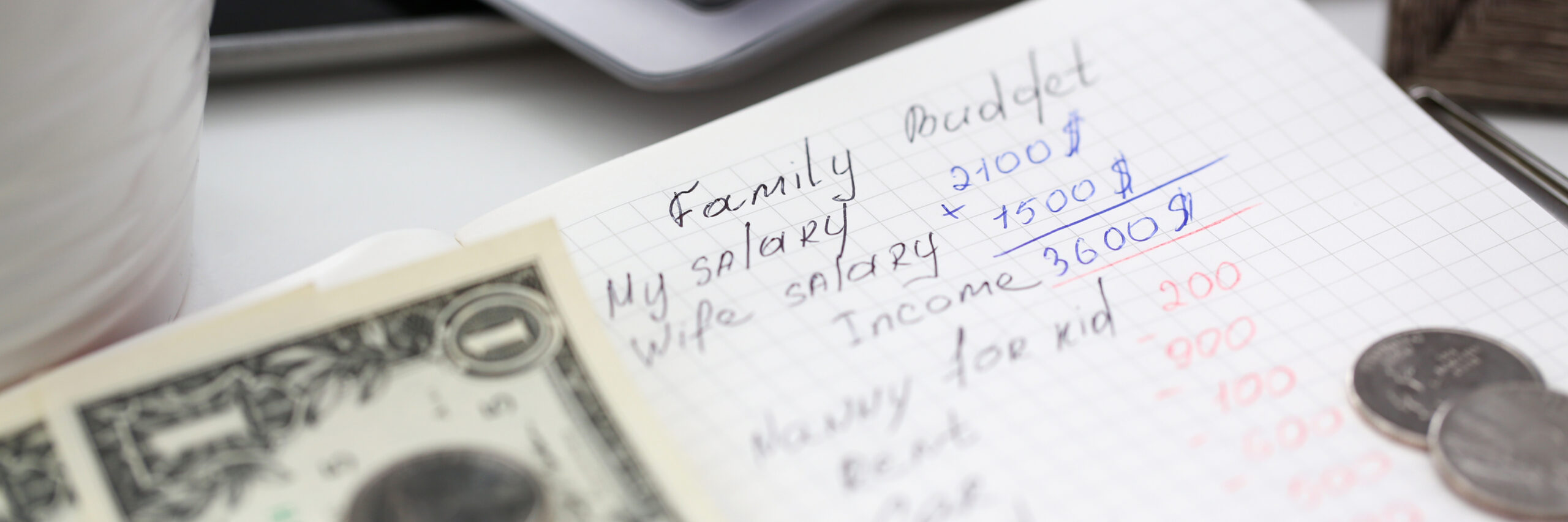

1. Calculate Your Income

Money in, money out. Before you can even begin to evaluate if you’re over or underspending, not saving enough or paying too much for car insurance, you must first understand what you’re working with. Calculate your total monthly net income by including earnings from all income sources, from both you and your partner or spouse, including any side gigs. Make sure you subtract out your health care premiums, pre-tax savings like 401k and of course taxes. If you are salaried, determine how many times per month you are paid (on average if bi-weekly or weekly) and just multiply that times the amount you see on your direct deposit each payday.

2. Track Your Spending & Lower Bills

If you don’t already keep track of your regular spending, there are lots of great programs out there that can help you categorize your spending so you can correctly allocate the right amount per month for gas, groceries, etc. Some of these programs can also help you find subscriptions you forgot about and unsubscribe from them with just a click. Here are a few:

Once you can see all of your monthly bills, you may also see an opportunity to decrease them in some areas. Finding better rates for things you can shop around for, like car insurance and home internet, is another great way to cut costs. If you’re frustrated with new fees each month and a constantly changing internet bill, consider making the switch to stress-free subscription billing with IQFiber. You can set up a notification for when we will have service in your area this year by signing up here.

3. Don’t Forget Unfixed Expenditures

You can estimate monthly expenses like groceries and gas, but some things are unpredictable like trips to the vet or appliance breakdowns. Do your best to plan for those things that you can, like car maintenance or kid’s after school programs. You can even estimate car maintenanceper year and then determine how much you should save per month to cover it.

For annual flex expenditures you can expect every year, like Christmas or birthday gifts, or even trips, create a separate bank account and set up automatic transfers on pay days so you are saving without much fuss or notice to your day-to-day. Apps like Acorn allow you to round up purchases and save the difference for a rainy day or vacation fund.

4. Categorize Your Spending

Whether you’re using a program or just a regular ol’ spreadsheet, it’s helpful to categorize your needs into three basic categories – needs, wants and goals.

Needs: Our needs include the basics like shelter and food, so groceries, gas, car payments, utilities, hygiene, medical care, taxes, school costs, etc. fit into this category.

Wants: New clothing or shoes, date nights, trips and gifts are some examples of things we may want but don’t need to survive each month.

Goals: The goal category may include fun things like vacations or saving up for a new car, motorcycle, golf cart, video game console, etc. or it may look more like debt payoff or investing in solar panels for your home. Whatever your goals look like, make sure to allocate any extra funds leftover in the month here before the monthly budget resets.

5. Stay Accountable

Whether it’s just you, or you and your significant other or family member sharing a budget, it’s important to stay accountable to the budget that you’ve set forth, once you have it determined. Checking your monthly reports or recalculating spending is a good idea on a monthly or at least quarterly basis. A budget can help you have a better handle on your finances and lead to long-term financial freedom.